Freelancing can be a rewarding career, but it often comes with financial uncertainty. One effective way to manage those finances is by identifying areas where you can save, such as utilizing resources like a book cover mockup to enhance your portfolio without overspending. In this article, we’ll delve into practical tips that can help you save $500 a month and improve your financial stability.

Freelancing offers incredible flexibility and opportunities, but it also comes with its own set of challenges, especially when it comes to managing finances. As a freelancer, the ability to save money can significantly impact your quality of life and future stability. In this article, we’ll explore practical strategies and tips that can help you save $500 a month as a freelancer without sacrificing your lifestyle or work quality.

Understanding Your Income and Expenses

Before diving into savings strategies, it’s essential to have a clear understanding of your monthly income and expenses. This foundational knowledge will guide your savings plan and help you identify areas for improvement.

1. Track Your Income

Maintaining a record of your income is crucial. Use tools like spreadsheets, accounting software, or apps to monitor all your earnings. Here are some methods:

- Use a dedicated accounting software like QuickBooks or FreshBooks.

- Keep a Google Sheet for easy access and updates.

- Utilize mobile apps like Wave or Expensify for on-the-go tracking.

2. Categorize Your Expenses

Divide your expenses into fixed and variable categories:

| Type | Examples |

|---|---|

| Fixed | Rent, utilities, insurance |

| Variable | Food, entertainment, software subscriptions |

Understanding these categories will allow you to see where you can cut back.

Creating a Budget

Once you have a grasp on your income and expenses, the next step is to create a budget. A budget acts like a roadmap for your finances, helping you allocate funds effectively.

1. The 50/30/20 Rule

A popular budgeting method is the 50/30/20 rule, which suggests that you allocate:

- 50% of your income to needs (necessities)

- 30% to wants (discretionary spending)

- 20% to savings and debt repayment

For freelancers, adjusting this rule may be necessary, especially when income fluctuates.

2. Set Specific Savings Goals

Instead of simply aiming to save $500, break that target into smaller, actionable goals:

- Save $125 each week.

- Identify specific expenses to cut that total $500.

- Consider side hustles or extra jobs to boost income.

Cutting Costs

Reducing your expenses can seem daunting, but there are numerous subtle adjustments you can make that collectively amount to significant savings.

1. Review Your Subscriptions

Evaluate any monthly subscriptions you have. Consider canceling or downgrading services that are underutilized. Some tips include:

- Streaming services: Keep only the most valuable ones.

- Software subscriptions: Use free alternatives or one-time purchases instead.

- Memberships: Evaluate their value against your actual usage.

2. Cut Down on Eating Out

Dining out can quickly eat into your budget. Here’s how to save:

- Plan meals and cook at home.

- Prepare lunches instead of buying them.

- Limit dining out to special occasions.

Increasing Your Income

While cutting costs is essential, increasing your income as a freelancer can also directly contribute to your savings goals.

1. Upskill

Invest in learning new skills that are in demand. Consider:

- Online courses in your field.

- Joining webinars and workshops.

- Networking to learn from industry experts.

2. Diversify Your Income Streams

Don’t rely solely on one client or project type. Diversifying can help mitigate risks. Here are some options:

- Take on part-time freelance gigs.

- Create digital products to sell (eBooks, courses).

- Offer consulting services in your area of expertise.

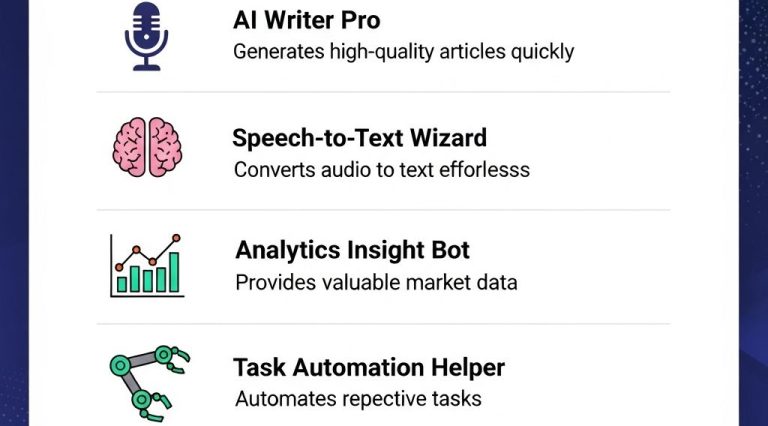

Utilizing Financial Tools

Leverage financial technology to manage your money better. Numerous apps and tools can assist in budgeting, tracking expenses, and saving.

1. Budgeting Apps

Consider using apps designed for budgeting:

- YNAB (You Need A Budget) helps you allocate your income effectively.

- Mint allows you to see all your accounts in one place.

- EveryDollar simplifies the budgeting process.

2. Savings Accounts

Open a separate savings account to set aside your savings. Some accounts offer better interest rates, which can help your savings grow over time:

- High-yield savings accounts.

- Certificates of deposit for longer-term savings.

Staying Motivated

Saving money can be challenging, but keeping yourself motivated is key. Here are some strategies:

1. Visualize Your Goals

Create a vision board or use apps to visualize what you’re saving for. This could include:

- A vacation

- A new gadget

- A financial safety net

2. Celebrate Milestones

Recognize and celebrate whenever you reach a savings milestone. This could be as simple as treating yourself to a small reward, which can help reinforce positive habits.

Conclusion

Saving $500 a month as a freelancer is entirely feasible with dedication and the right strategies. By understanding your finances, creating a budget, cutting unnecessary costs, and increasing your income, you can build a stable financial future. Remember, small changes can lead to significant savings over time. Commit to these practices, and you’ll find that saving money becomes a natural part of your freelancing journey.

FAQ

How can freelancers effectively save $500 a month?

Freelancers can save $500 a month by budgeting, cutting unnecessary expenses, using tools for time management, and increasing their rates or client base.

What are some common expenses freelancers should track?

Common expenses include software subscriptions, office supplies, internet costs, and marketing expenses. Tracking these can help identify areas to cut back.

Are there specific tools to help freelancers save money?

Yes, tools like budgeting apps, invoicing software, and expense trackers can help freelancers manage their finances more effectively.

How can freelancers increase their income to save more?

Freelancers can increase their income by offering additional services, raising rates, or acquiring more clients through networking and marketing.

What budgeting methods are best for freelancers?

The zero-based budgeting method and the 50/30/20 rule are popular among freelancers for managing income and expenses effectively.

Should freelancers have an emergency fund?

Yes, having an emergency fund is crucial for freelancers to cover unexpected expenses and ensure financial stability.