Freelancing presents unique financial challenges, but with strategic planning, you can save considerably. Understanding your income and creating a realistic budget are foundational steps. Additionally, enhancing your skills through resources like a creative book presentation can lead to increased earnings.

Freelancing has become a popular career choice for many professionals, offering flexibility and autonomy. However, managing finances as a freelancer can be challenging, especially when it comes to savings. In this article, we’ll explore practical strategies to help you save $1,000 a year while navigating the ups and downs of freelancing.

Understanding Your Income

The first step in saving money as a freelancer is to have a clear understanding of your income. Unlike traditional jobs, freelancers often experience fluctuating income streams. Here are some steps to get started:

Tracking Your Earnings

- Use accounting software or a simple spreadsheet to keep track of all your projects and payments.

- Classify your income into fixed and variable categories.

- Review your earnings monthly to identify trends and adjust your budget accordingly.

Creating a Realistic Budget

Once you have a good grasp of your earnings, it’s crucial to create a budget that aligns with your financial goals. A budget helps you live within your means and sets the stage for saving.

Essential Budgeting Steps

- Determine your essential monthly expenses, such as rent, utilities, and food.

- Allocate funds for business-related expenses, including software, tools, and marketing.

- Set aside a percentage of your income for savings, ideally 20% or more if possible.

Cutting Unnecessary Expenses

To save $1,000 a year, consider reviewing your spending habits and cutting unnecessary expenses. Here are some areas to examine:

Potential Cost-Saving Areas

| Expense Category | Suggestions |

|---|---|

| Subscriptions | Cancel unused memberships and consider sharing accounts with friends. |

| Software | Explore free or low-cost alternatives to expensive software. |

| Workspace | Consider co-working spaces or working from home instead of renting an office. |

Maximizing Your Earnings

In addition to cutting costs, increasing your income is another way to boost your savings. Here are some strategies to maximize your earnings:

Diversifying Your Income Streams

- Offer different services to attract a broader client base.

- Consider creating digital products, such as ebooks or online courses.

- Engage in affiliate marketing or collaborations to generate passive income.

Raising Your Rates

As you gain more experience and develop your skills, don’t hesitate to raise your rates. Here’s how to approach it:

- Research market rates to ensure your pricing is competitive.

- Communicate your value and the improvements in your skills to existing clients.

- Implement rate increases gradually to avoid losing clients.

Building an Emergency Fund

An emergency fund is a financial cushion that can prevent you from dipping into your savings when unexpected expenses arise. Aim to save at least three to six months’ worth of living expenses. Here are some tips for building your fund:

Steps to Build an Emergency Fund

- Open a separate savings account dedicated to your emergency fund.

- Set up automatic transfers from your checking to your savings account each month.

- Consider using windfalls, such as tax refunds or bonuses, to boost your savings.

Investing in Yourself

Investing in your skills and knowledge can lead to higher earnings and savings in the long run. Here’s how to invest wisely:

Opportunities for Self-Improvement

- Take online courses to enhance your skills and knowledge.

- Attend industry conferences, webinars, or networking events.

- Read books and articles related to your field to stay updated.

Utilizing Financial Tools

Several financial tools can help freelancers stay organized and save money:

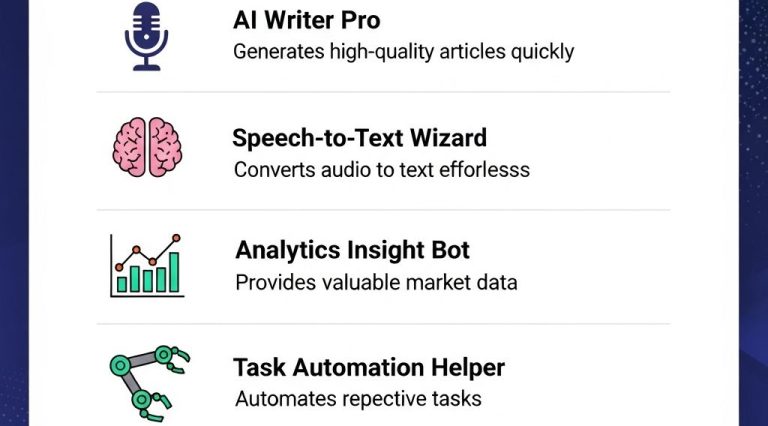

Recommended Financial Tools

| Tool | Purpose |

|---|---|

| QuickBooks | Accounting and invoicing. |

| Mint | Budget tracking and financial planning. |

| Expensify | Expense tracking and management. |

Review and Adjust Regularly

Lastly, make it a habit to review your financial situation regularly. Adjust your budget and savings plan based on changes in income or expenses.

Tips for Regular Reviews

- Set a monthly date to review your budget and expenses.

- Analyze your spending to identify any new areas to cut costs.

- Re-evaluate your savings goals and adjust as needed.

Conclusion

Saving $1,000 a year as a freelancer is achievable with intentional planning and diligent tracking of your finances. By understanding your income, creating a budget, cutting unnecessary expenses, maximizing your earnings, building an emergency fund, investing in yourself, and using financial tools, you can establish a solid financial foundation. Start implementing these strategies today and watch your savings grow!

FAQ

How can freelancers save $1,000 a year?

Freelancers can save $1,000 a year by budgeting effectively, tracking expenses, utilizing tax deductions, and choosing cost-effective tools and software.

What are the best budgeting tips for freelancers?

Freelancers should create a detailed monthly budget, set aside money for taxes, and regularly review their expenses to identify areas for savings.

Which tax deductions can freelancers take advantage of?

Freelancers can deduct home office expenses, software subscriptions, equipment purchases, and business-related travel, which can significantly reduce their taxable income.

Are there cost-effective tools for freelancers?

Yes, freelancers can use free or low-cost tools for project management, invoicing, and communication, such as Trello, Wave, and Slack, to minimize overhead costs.

How can I increase my income as a freelancer?

Freelancers can increase their income by diversifying their services, raising their rates, and actively seeking new clients through networking and online platforms.