In the quest for financial independence, understanding various income streams is essential. Among these, real estate is particularly compelling, offering opportunities for passive income with minimal daily involvement. For those venturing into real estate or seeking to enhance their marketing efforts, utilizing a well-crafted book mockup design can effectively showcase strategies and insights.

In today’s fast-paced digital age, the pursuit of passive income has become a common goal for many individuals seeking financial independence. Among various avenues available, real estate remains one of the most attractive options for generating income without the need for constant active involvement. This article delves into the different strategies and considerations involved in earning passive income through real estate investments.

Understanding Passive Income

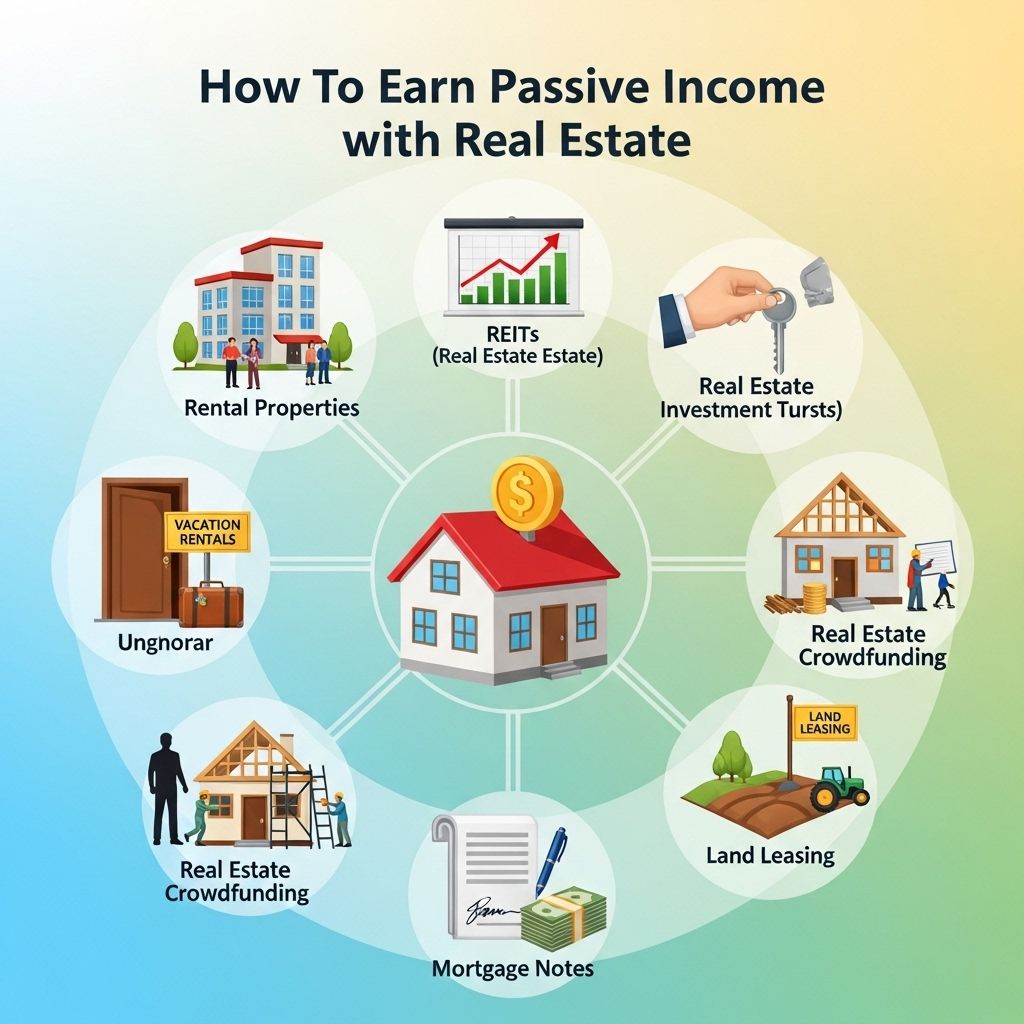

Passive income refers to money earned with minimal active involvement. Unlike traditional jobs where time equals money, passive income allows individuals to earn funds through investments or businesses that require little daily effort. Real estate investments can yield a steady stream of passive income in several forms, including rental income, real estate investment trusts (REITs), and property appreciation.

Types of Real Estate Investments

Before exploring how to earn passive income through real estate, it’s essential to understand the different types of real estate investments available. Each type has its unique benefits and challenges:

1. Residential Rental Properties

Owning residential properties, such as single-family homes or multi-family units, is one of the most straightforward methods of earning passive income. Investors purchase these properties and rent them out to tenants, generating monthly rental payments. Key considerations include:

- Location: Properties in desirable neighborhoods typically yield higher rental income.

- Property Management: Investors can manage properties themselves or hire a property management company.

- Maintenance Costs: Regular maintenance and unexpected repairs can affect profitability.

2. Commercial Real Estate

Investing in commercial properties, such as office buildings, retail spaces, or warehouses, can provide substantial returns. Commercial leases are often longer-term, leading to more stable income. Important factors to consider include:

- Market Research: Understanding market demand for commercial spaces is crucial.

- Tenant Stability: Long-term leases with stable businesses can minimize turnover costs.

- Financing: Commercial properties often require larger capital investments.

3. Real Estate Investment Trusts (REITs)

For those who prefer a less hands-on approach, investing in REITs can be an excellent option. REITs are companies that own, operate, or finance income-producing real estate. By purchasing shares of a REIT, investors can earn dividends without directly managing properties. Key benefits include:

- Liquidity: REITs are traded like stocks, making them more liquid than traditional real estate investments.

- Diversification: Investing in a REIT can provide exposure to various property types and locations.

- Lower Entry Costs: Investors can start with lower capital compared to direct property ownership.

Steps to Start Earning Passive Income with Real Estate

To successfully earn passive income through real estate, follow these steps:

1. Define Your Investment Goals

Understanding what you aim to achieve with your real estate investments is crucial. Consider factors such as:

- Desired monthly income

- Investment duration

- Level of involvement

2. Educate Yourself on Real Estate Markets

Knowledge is power in real estate. Familiarize yourself with different markets and investment options by:

- Reading books and articles on real estate investing

- Attending workshops and seminars

- Joining real estate investing groups or forums

3. Analyze Potential Properties

Conduct thorough analysis when evaluating properties for investment. Important metrics to consider include:

| Metric | Description | Importance |

|---|---|---|

| Cash Flow | The income remaining after all expenses | Ensures profitability |

| Cap Rate | Net operating income divided by property value | Measures potential return on investment |

| Appreciation Rate | Expected increase in property value over time | Long-term investment value |

4. Secure Financing

Explore financing options that suit your investment strategy, such as:

- Conventional mortgages

- Hard money loans

- Partnerships or syndications

5. Manage Your Investments Wisely

After acquiring properties, effective management is key to maintaining income streams. Consider the following:

- Regularly assess rental prices to ensure they align with market rates.

- Keep properties well-maintained to attract and retain tenants.

- Stay informed about local laws and regulations impacting rental properties.

Potential Challenges and Risks

While earning passive income through real estate can be lucrative, it is not without risks. Key challenges include:

1. Market Fluctuations

Real estate markets can experience volatility, affecting property values and rental income. Stay informed about market trends and economic indicators.

2. Property Management Issues

Managing properties can lead to tenant-related challenges, such as late payments or property damage. Establish clear rental agreements and screening processes.

3. Unexpected Costs

Maintenance and repair costs can arise unexpectedly, impacting cash flow. Set aside a reserve fund for emergencies.

Conclusion

Earning passive income through real estate offers a promising path to financial independence. By understanding the various types of investments, strategically analyzing properties, and managing your investments effectively, you can create a sustainable income stream. While challenges exist, the potential rewards make real estate a worthwhile consideration for those looking to build wealth over time.

FAQ

What is passive income in real estate?

Passive income in real estate refers to earnings generated from rental properties or real estate investments where the owner does not actively manage the property on a day-to-day basis.

What are some common ways to earn passive income in real estate?

Common ways to earn passive income in real estate include owning rental properties, investing in Real Estate Investment Trusts (REITs), or crowdfunding real estate platforms.

How much money do I need to start earning passive income in real estate?

The amount of money needed to start earning passive income in real estate varies, but typically ranges from a few thousand dollars for REITs to tens of thousands for rental properties.

Is real estate a good investment for passive income?

Yes, real estate can be a good investment for passive income due to its potential for appreciation, cash flow from rentals, and tax advantages.

What are the risks associated with earning passive income in real estate?

Risks include market fluctuations, property management challenges, unexpected repairs, and potential vacancy periods that can affect cash flow.

Can I earn passive income from real estate without owning property?

Yes, you can earn passive income from real estate without owning property by investing in REITs or real estate crowdfunding platforms.