As we delve into the era of artificial intelligence, it becomes crucial for businesses and individuals alike to harness the power of AI tools to optimize their budgets and enhance productivity. The landscape of financial management is evolving, and those who adapt will not only survive but thrive in the competitive market of 2025 and beyond.

The Role of AI in Financial Management

AI is transforming various sectors, and financial management is no exception. With capabilities such as predictive analytics, natural language processing, and machine learning, AI tools can provide insights that were previously unattainable. Here’s how AI enhances financial strategies:

- Predictive Analytics: AI tools can forecast trends, helping businesses to make informed decisions about spending and investments.

- Cost Reduction: Automation of repetitive tasks reduces labor costs significantly.

- Real-time Insights: Instant data processing allows for real-time financial monitoring and quick adjustments.

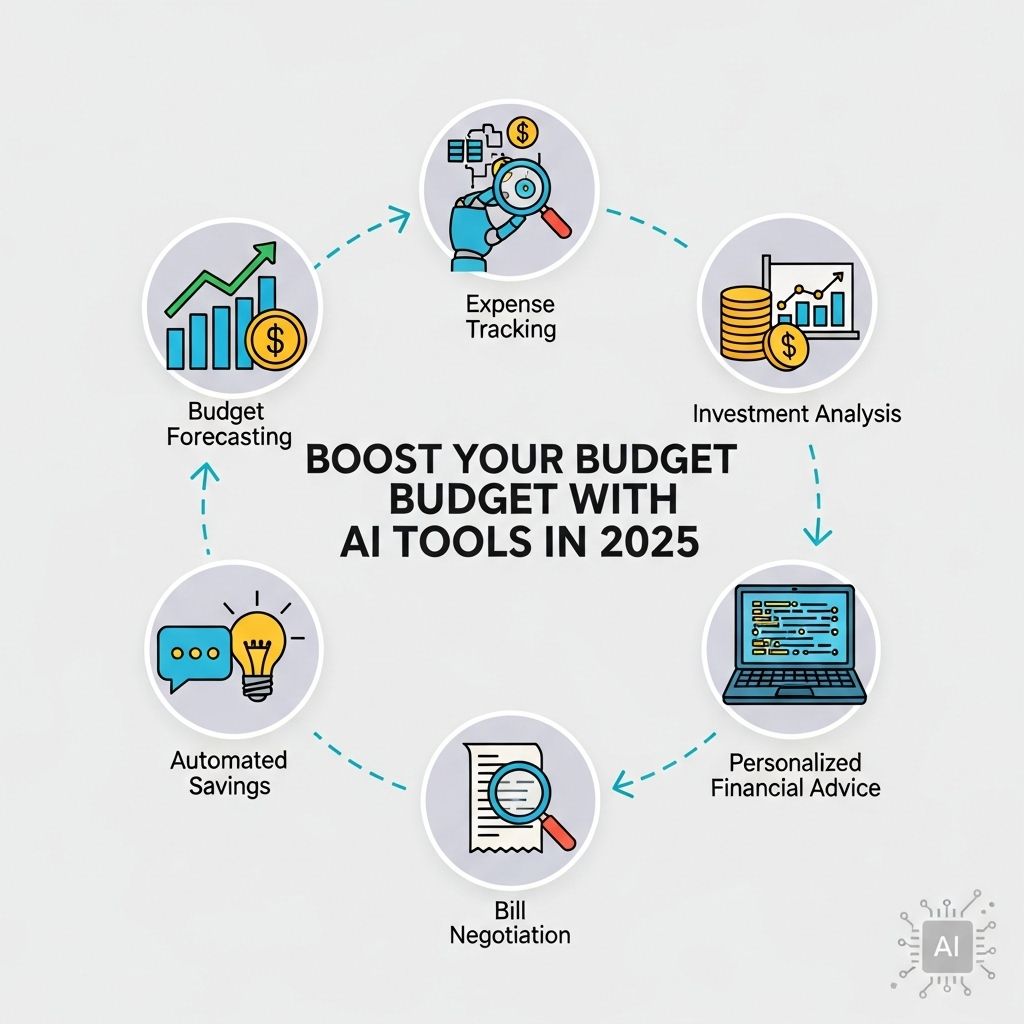

Must-Have AI Tools for Budget Management in 2025

As AI technology progresses, various tools have emerged that cater specifically to budget management. Below are essential AI-powered tools that businesses should consider integrating into their financial operations:

1. Expense Tracking Software

AI-driven expense tracking software simplifies the process of recording, categorizing, and analyzing expenses. These tools can automate data entry, making it easy to manage and control spending.

2. Budgeting Applications

Advanced budgeting applications use AI to analyze spending patterns and predict future expenses. Features often include:

- Smart categorization of expenses

- Alerts for overspending

- Recommendations for budget adjustments

3. Financial Forecasting Tools

AI-based forecasting tools utilize historical data and market analysis to predict future revenues and expenses. These insights enable better strategic planning and resource allocation.

| Tool Name | Key Features | Best For |

|---|---|---|

| Expensify | Smart receipt scanning, automated expense reports | Small to medium businesses |

| Mint | Personal finance tracking, budgeting | Individuals and families |

| QuickBooks | Comprehensive accounting, budgeting features | Small businesses |

Integrating AI into Your Financial Strategy

Implementing AI tools into your financial management strategy requires a thoughtful approach. Here are steps to ensure a successful integration:

Step 1: Identify Your Needs

Begin by assessing your current financial processes. Determine which areas could benefit from automation and AI capabilities.

Step 2: Research Tools

Explore various AI tools tailored to your needs. Consider aspects such as:

- User-friendliness

- Integration with existing systems

- Customer support and training

Step 3: Pilot Program

Before full-scale implementation, run a pilot program with selected tools. This allows you to evaluate effectiveness without major commitments.

Step 4: Train Your Team

Ensure your team is trained on how to use the new tools effectively. A well-informed team can leverage AI features to maximize budgetary benefits.

Case Studies: Success Stories of AI Implementation

Several companies have successfully integrated AI tools into their financial management strategies, leading to significant improvements in budget control and operational efficiency. Here are a couple of notable examples:

1. Company A: Streamlining Expenses

Company A implemented an AI-driven expense tracking system that automated their reporting processes. As a result, they reduced time spent on expense management by 40% and uncovered hidden costs amounting to 15% of their overall spending.

2. Company B: Enhanced Budgeting

Company B adopted an AI-based budgeting application that provided insights into spending patterns. By utilizing predictive analytics, they adjusted their budget allocation, which led to a 25% increase in operational efficiency.

Future Trends in AI and Financial Management

As we look ahead to 2025 and beyond, several trends are emerging in the use of AI within financial management:

1. Increased Personalization

AI tools are becoming more personalized, allowing users to receive tailored recommendations based on individual financial behaviors.

2. Enhanced Security

With the rise of AI comes advanced security measures, utilizing machine learning to detect fraudulent activities in real time.

3. Greater Accessibility

The democratization of AI technology will make powerful financial tools accessible to even the smallest businesses and individuals.

Conclusion

In the evolving financial landscape of 2025, the integration of AI tools into budget management is no longer a luxury but a necessity. By adopting these technologies, businesses can not only optimize their financial strategies but also gain a competitive edge in an increasingly data-driven world. Investing in AI tools today sets the stage for a more efficient, insightful, and effective financial future.

FAQ

What are AI tools and how can they help boost my budget in 2025?

AI tools are software applications that utilize artificial intelligence to analyze data, automate processes, and enhance decision-making. In 2025, these tools can help boost your budget by optimizing spending, forecasting expenses, and identifying cost-saving opportunities.

Which AI tools are recommended for budgeting and financial planning in 2025?

Some recommended AI tools for budgeting and financial planning in 2025 include budgeting software like Mint, expense tracking apps like Expensify, and forecasting tools like Planful, all enhanced with AI capabilities for better insights.

Can AI tools help small businesses manage their budgets effectively?

Yes, AI tools can significantly help small businesses manage their budgets by providing real-time analytics, automating repetitive tasks, and offering personalized financial advice, thereby improving overall financial health.

How can I integrate AI tools into my existing budgeting process in 2025?

To integrate AI tools into your existing budgeting process, start by identifying your specific needs, researching compatible software, and training your team on how to use these tools effectively to maximize benefits.

Are there any risks associated with using AI tools for budgeting?

While AI tools offer numerous benefits, there are risks such as data privacy concerns, reliance on algorithms that may not account for unique business factors, and the need for ongoing monitoring to ensure accuracy and effectiveness.