As we look toward 2025, the wealth management sector is poised for transformation, largely driven by the integration of artificial intelligence. This adoption is not just about enhancing efficiency but also about personalizing client experiences, allowing for tailored strategies that meet individual financial goals. For those interested in design inspiration, exploring unique bag concepts can provide valuable insights into personalization trends in various fields.

The financial landscape is continuously evolving, and the integration of artificial intelligence (AI) into wealth management processes is leading the charge into a new era. By 2025, the trends that will shape the sector are already emerging, driven by advancements in technology, user expectations, and the need for deeper analytical insights. Understanding these trends can help investors, financial advisors, and firms streamline their strategies and improve client outcomes.

Understanding AI in Wealth Management

Artificial intelligence refers to computer systems that simulate human intelligence to analyze data, recognize patterns, and make decisions. In wealth management, AI applications can automate repetitive tasks, provide data-driven insights, and enhance decision-making processes. This shift not only increases efficiency but also leads to more personalized and informed investment strategies.

The Rise of Robo-Advisors

Robo-advisors have gained popularity due to their cost-effectiveness and accessibility. By 2025, we expect to see:

- Enhanced Algorithms: More sophisticated algorithms that analyze complex data sets to offer personalized investment strategies.

- Increased Personalization: Tailored investment plans that consider individual risk tolerance, financial goals, and market conditions.

- Integration with Traditional Advisory Services: A hybrid model where human advisors work alongside robo-advisors to provide a comprehensive service.

Data Analytics for Better Insights

Data analytics plays a crucial role in shaping investment strategies. Here’s how AI will leverage analytics in wealth management:

- Predictive Analytics: AI systems will analyze historical data to forecast market trends and investment risks.

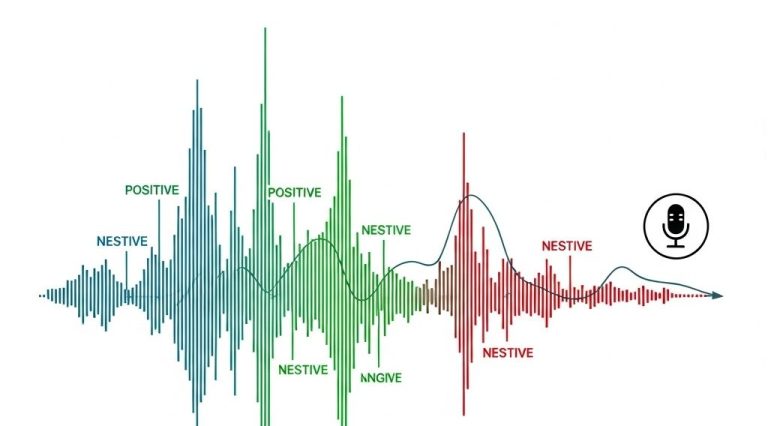

- Sentiment Analysis: Monitoring social media and news platforms to gauge market sentiment and inform investment decisions.

- Behavioral Insights: Understanding investor behavior and preferences through data mining to enhance client engagement.

AI-Powered Personalized Client Interaction

As competition increases, personalized communication becomes essential. AI-driven tools will change how wealth managers interact with clients:

Chatbots and Virtual Assistants

AI-powered chatbots are becoming crucial in providing 24/7 client support:

| Feature | Functionality |

|---|---|

| 24/7 Availability | Clients can access information and assistance at any time. |

| Instant Responses | Quick answers to frequently asked questions, reducing wait times. |

| Personalized Recommendations | Suggesting investment opportunities based on client profiles. |

Enhanced Client Education

AI will facilitate the dissemination of knowledge:

- Tailored Learning Modules: Providing clients with educational content tailored to their investment knowledge and interests.

- Interactive Tools: Simulations and modeling tools that help clients understand investment scenarios.

Risk Management and Compliance

With the increase in regulatory scrutiny, compliance will play a crucial role in wealth management. AI can assist in:

Real-Time Risk Assessment

AI systems can continuously monitor market conditions to identify potential risks:

- Dynamic Risk Scoring: Assigning risk scores to investment portfolios based on various factors.

- Alerts and Notifications: Real-time alerts for significant market changes or compliance issues.

Automating Compliance Processes

Automation will streamline compliance tasks:

- Document Verification: Using AI to verify client documentation and assess suitability for investment products.

- Transaction Monitoring: Continuous monitoring of transactions to identify suspicious activities.

Integration with Other Technologies

AI will not operate in isolation. By 2025, we expect significant integration with other technologies:

Blockchain Integration

The combination of AI and blockchain could revolutionize wealth management:

- Secure Transactions: Using blockchain for secure and transparent transaction processing.

- Smart Contracts: Automating compliance and trade agreements through AI-driven smart contracts.

Machine Learning and Big Data

Machine learning will enhance AI’s capability to process big data:

- Enhanced Learning: AI learns from data trends, improving predictions and recommendations.

- Scalability: Ability to process vast amounts of data efficiently for better insights.

The Future of Human Advisors

While AI is transforming wealth management, the role of human advisors remains critical:

Advisors as Relationship Managers

By leveraging AI, human advisors can focus on building relationships:

- Emotional Intelligence: Understanding and addressing clients’ emotional and psychological needs.

- Complex Needs: Providing strategic advice for complex portfolio management that requires human judgement.

Client Trust and Ethical Considerations

Trust will be paramount in the age of AI:

- Transparency: Clients will demand transparency in how AI systems make decisions.

- Data Privacy: Ensuring clients’ data is used responsibly and ethically.

Conclusion

As we move towards 2025, the trends in AI-driven wealth management reflect a paradigm shift towards automation, personalization, and intelligent decision-making. By embracing these trends, wealth managers can enhance the client experience, improve operational efficiency, and position themselves as leaders in the market. The future holds immense potential for those who adapt to the evolving technological landscape while maintaining a focus on the human elements of financial advisory.

FAQ

What are the key AI-driven wealth management trends expected in 2025?

In 2025, key trends include enhanced personalized investment strategies, AI-driven robo-advisors, predictive analytics for market trends, improved risk management through machine learning, and increased use of natural language processing for client communications.

How will AI change the client experience in wealth management by 2025?

AI is expected to revolutionize the client experience in wealth management by providing tailored investment advice, real-time portfolio management, and 24/7 access to financial insights through virtual assistants.

What role will big data play in AI-driven wealth management by 2025?

Big data will play a crucial role in AI-driven wealth management by allowing firms to analyze vast amounts of market and client data to make informed investment decisions and create highly personalized financial products.

Will AI replace human financial advisors in wealth management by 2025?

While AI will enhance many aspects of wealth management, it is expected to complement rather than replace human financial advisors, as personal relationships and complex decision-making will still be vital.

How can investors benefit from AI-driven wealth management tools in 2025?

Investors can benefit from AI-driven wealth management tools in 2025 through more efficient portfolio management, improved access to investment opportunities, and better risk assessment, leading to potentially higher returns.