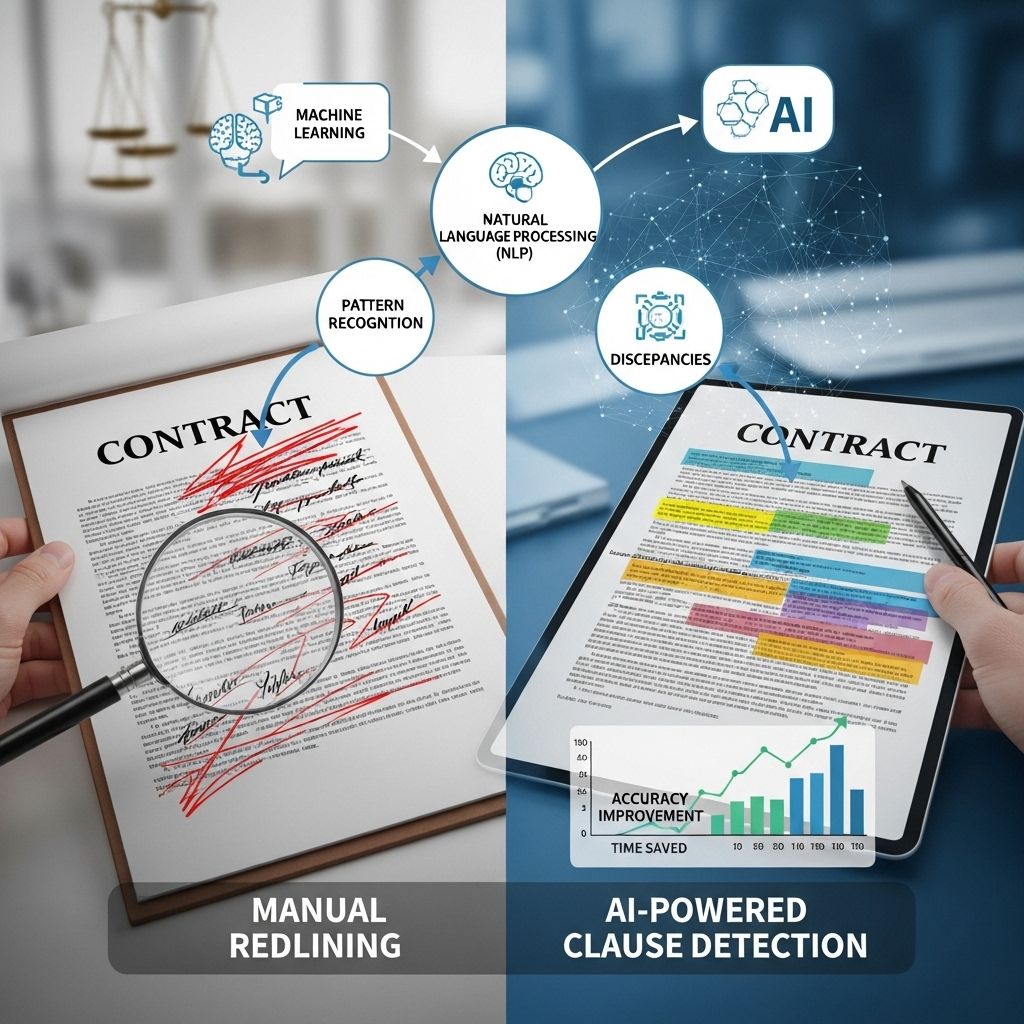

In an era where technology is reshaping industries, artificial intelligence (AI) is playing a pivotal role in transforming how we understand and interact with complex societal issues. One such area where AI is making significant strides is in the detection of redlining practices and the analysis of related clauses in financial and real estate documentation. Redlining, the discriminatory practice of denying services to residents of certain areas based on racial or ethnic composition, has left a lasting impact on communities. With the rise of machine learning and natural language processing, AI offers new methodologies to identify these practices and promote equitable access to resources.

Understanding Redlining

Redlining originated in the 1930s when government-backed loans were systematically denied to residents in predominantly minority neighborhoods. This practice fostered socio-economic disparities that are still prevalent today. The following points illustrate the implications of redlining:

- Economic Disparities: Redlined areas often suffer from underinvestment, leading to lower property values.

- Healthcare Access: Residents may have limited access to quality healthcare services.

- Educational Opportunities: Schools in these areas typically receive less funding.

- Social Isolation: Communities may face systemic segregation from access to essential services.

The Role of AI in Detecting Redlining

AI technologies can help identify patterns and behaviors indicative of redlining by analyzing large amounts of data that reflect housing and lending practices. Key methodologies include:

Data Collection and Analysis

AI systems rely on diverse datasets to uncover discriminatory practices. Key data points include:

- Demographic information

- Loan application data

- Geographic information systems (GIS) data

- Property value assessments

Machine learning algorithms can process this information and reveal correlations that would be difficult to detect manually.

Natural Language Processing (NLP)

By employing NLP techniques, AI can analyze text data from financial documents, advertisements, and correspondence to identify discriminatory language. NLP can be utilized in the following ways:

Identifying biased language in loan applications and marketing materials.

For example, phrases that imply exclusivity or preference based on race or ethnicity can be flagged for further review. This textual analysis is crucial for assessing lender practices and enforcing compliance with fair housing regulations.

Clause Detection in Financial Documents

Beyond analyzing demographic data, AI can also focus on the specific clauses within financial contracts. Key areas for clause detection include:

Automated Document Review

AI algorithms can be trained to review contracts, loan agreements, and other legal documentation for redlining-related clauses. This can involve:

- Identifying exclusionary clauses that may limit access to loans based on location or demographic information.

- Assessing terms that disproportionately impact certain communities.

- Highlighting inconsistencies in loan terms compared to regulatory standards.

Machine Learning Models for Clause Detection

Machine learning models can be designed to detect specific patterns in financial documents:

| Model Type | Application | Advantages |

|---|---|---|

| Supervised Learning | Trains on labeled data to identify discriminatory clauses | High accuracy with large datasets |

| Unsupervised Learning | Categorizes documents based on inherent similarities | Useful for discovering unknown patterns |

| Reinforcement Learning | Improves detection strategies through trial and error | Adapts to changing patterns in documentation |

Implications for Fair Lending Practices

The integration of AI in redlining detection has crucial implications for fair lending practices:

Regulatory Compliance

Financial institutions are mandated to comply with fair housing laws. AI tools can help ensure compliance by:

- Providing audits of lending practices

- Recommending corrective actions for non-compliance

- Generating reports for regulatory bodies

Promoting Transparency

AI can enhance transparency within the lending process. By utilizing AI-driven insights, organizations can:

- Communicate lending criteria clearly to applicants.

- Educate stakeholders about anti-discrimination laws.

- Foster trust within communities by demonstrating fair practices.

Challenges and Ethical Considerations

While AI offers numerous benefits in detecting redlining and clause violations, there are challenges and ethical considerations:

Data Privacy

Handling sensitive demographic and financial data raises significant privacy concerns. Organizations must ensure:

- Compliance with data protection regulations such as GDPR and CCPA.

- Secure data storage and processing practices.

Algorithmic Bias

AI systems can inadvertently perpetuate bias present in training data. To combat this:

- Regularly audit AI models for bias.

- Incorporate diverse datasets in training.

Case Studies of AI Implementation

Several organizations have successfully employed AI to combat redlining:

Example 1: The Home Ownership Preservation Foundation

This nonprofit utilized machine learning to analyze mortgage data, identifying patterns of discrimination effectively. Their efforts have led to increased awareness and accountability among lenders.

Example 2: The Fair Housing Justice Center

Using NLP tools, this organization reviewed thousands of rental listings and found a significant number of discriminatory advertisements, prompting legal action against violators.

Future Directions

As technology evolves, the potential for AI to address redlining and related inequities could expand further. Future efforts may include:

- Enhanced predictive analytics to foresee discriminatory lending practices.

- Collaboration between tech firms and civil rights organizations.

- Development of comprehensive AI frameworks that encompass ethical considerations.

Conclusion

AI stands poised to make significant contributions in the fight against redlining and discrimination in lending. By leveraging data analysis and language processing techniques, these technologies can uncover inequities, promote transparency, and drive compliance with fair lending practices. However, it is crucial to navigate the challenges of data privacy and algorithmic bias to ensure that these advancements serve to uphold justice and equality. As we venture further into the tech-driven future, a commitment to ethical AI deployment will be key in fostering sustainable change in our communities.

FAQ

What is AI for redlining and clause detection?

AI for redlining and clause detection refers to the use of artificial intelligence technologies to identify, analyze, and highlight specific clauses or terms in legal documents, particularly those that may be discriminatory or non-compliant.

How does AI improve the process of redlining detection?

AI improves redlining detection by automating the analysis of large volumes of legal documents, quickly identifying harmful clauses and allowing for a more efficient review process.

What are the benefits of using AI for clause detection in legal documents?

The benefits include increased accuracy, faster turnaround times, reduced risk of human error, and the ability to uncover hidden patterns of discrimination in contracts.

Can AI replace human lawyers in redlining and clause detection?

While AI can significantly enhance the efficiency and accuracy of detecting redlining and clauses, it is not intended to replace human lawyers but rather to assist them in their review processes.

What industries can benefit from AI redlining and clause detection?

Industries such as real estate, finance, insurance, and any sector involving legal contracts can benefit from AI redlining and clause detection to ensure compliance and fairness.

Is AI for redlining and clause detection cost-effective?

Yes, utilizing AI for redlining and clause detection can be cost-effective by reducing the time and resources needed for manual reviews, thus lowering overall operational costs.