As businesses navigate the evolving landscape of payroll technology, integrating AI solutions is becoming increasingly vital. These advancements promise to enhance accuracy and efficiency, much like how unique bag concepts can transform design processes in other sectors. By understanding these shifts, organizations can better prepare for the future of payroll management.

As we advance into a new era of technological innovation, businesses are increasingly turning to artificial intelligence (AI) to streamline their operations and enhance efficiency. In the realm of payroll, AI-powered solutions are set to revolutionize how organizations manage their employee compensation, tax compliance, and reporting. This article explores the transformative potential of AI in payroll functions by 2025, examining its benefits, implications, and the future landscape.

Understanding AI in Payroll

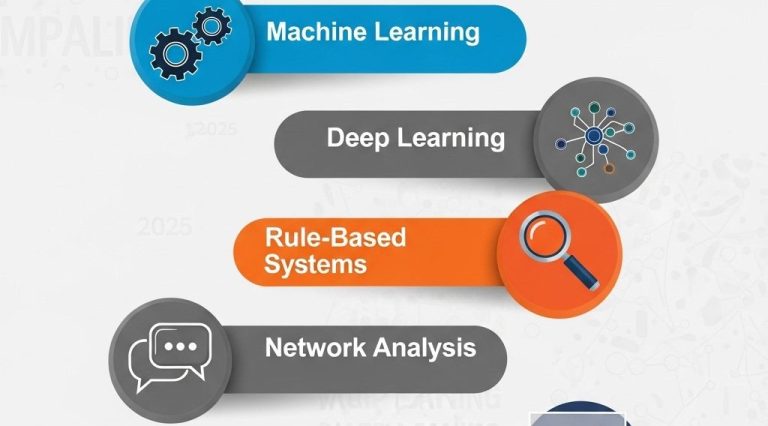

AI in payroll involves using artificial intelligence technologies, such as machine learning and natural language processing, to automate and optimize payroll processes. The integration of AI can lead to significant improvements, including:

- Automation: Minimizing manual data entry and reducing human error.

- Efficiency: Speeding up payroll processing times and ensuring timely payments.

- Compliance: Enhancing accuracy in tax calculations and adherence to regulatory requirements.

The Benefits of AI-Powered Payroll Solutions

Implementing AI in payroll systems offers numerous advantages for businesses. Some of the key benefits include:

1. Increased Accuracy

AI algorithms can analyze vast amounts of data to ensure that payroll calculations are accurate. By using predictive analytics, these systems can identify discrepancies before they lead to costly mistakes. This not only safeguards employee earnings but also protects the company from expensive penalties due to compliance issues.

2. Time Savings

AI can automate repetitive tasks, such as data entry, time tracking, and report generation, allowing HR professionals to focus on strategic initiatives rather than administrative duties. This efficiency can lead to:

- Reduced payroll processing time.

- Enhanced employee satisfaction due to timely and accurate payments.

3. Enhanced Decision Making

With AI’s ability to analyze trends and generate insights, businesses can make informed decisions regarding compensation strategies and workforce management. By leveraging data, companies can:

- Optimize salary structures based on market trends.

- Identify patterns in employee performance and retention.

Challenges and Considerations

While AI offers numerous benefits, implementing AI-powered payroll solutions also presents challenges that organizations must consider:

Data Privacy Concerns

Payroll data is sensitive and must be handled securely to protect employee information. Organizations need to ensure that their AI systems comply with data protection regulations, such as GDPR and CCPA. Key considerations include:

- Implementing robust encryption methods.

- Regularly auditing data access and usage.

Integration with Existing Systems

Integrating AI solutions with current payroll systems can pose technical challenges. To ensure a smooth transition, businesses should:

- Conduct thorough compatibility assessments.

- Invest in training for HR personnel on new systems.

Future Trends in AI-Powered Payroll

As we look ahead to 2025 and beyond, several key trends are likely to shape the future of AI in payroll:

1. Greater Personalization

AI systems will increasingly tailor payroll processes to individual employee needs. This could include personalized payment schedules or benefits recommendations based on an employee’s financial situation.

2. Advanced Analytics

The growth of AI will enable more sophisticated analytics capabilities, allowing organizations to gain deeper insights into workforce metrics. Businesses may leverage these insights for:

- Strategic workforce planning.

- Enhanced employee engagement initiatives.

3. Real-time Processing

Future AI developments may allow for real-time payroll processing, enabling businesses to provide instant payments to employees. This could significantly improve cash flow management and employee satisfaction.

Conclusion

The integration of AI in payroll systems marks a significant shift in how businesses manage employee compensation and compliance. By leveraging AI-powered payroll solutions, organizations can achieve greater accuracy, efficiency, and strategic insights, all while mitigating common payroll challenges. As we approach 2025, the emphasis on AI in payroll will only grow, making it essential for businesses to stay ahead of the curve to remain competitive in a rapidly evolving marketplace.

FAQ

What are AI-powered payroll solutions?

AI-powered payroll solutions use artificial intelligence to automate and streamline payroll processes, enhancing accuracy and efficiency while reducing manual intervention.

How can AI improve payroll accuracy?

AI can reduce human errors, ensure compliance with regulations, and analyze data patterns, leading to more accurate payroll calculations and timely payments.

What features should I look for in an AI payroll solution for 2025?

Key features to consider include automated tax calculations, integration with HR systems, real-time analytics, customizable reporting, and user-friendly interfaces.

Is employee data secure in AI-powered payroll systems?

Yes, reputable AI payroll solutions prioritize data security by implementing encryption, access controls, and compliance with data protection regulations.

Can AI payroll solutions handle international payroll?

Many AI payroll solutions are designed to manage international payroll, accommodating multiple currencies, tax laws, and compliance requirements across different countries.

How do AI payroll solutions benefit small businesses?

AI payroll solutions help small businesses save time and reduce costs by automating repetitive tasks, minimizing errors, and providing insights for better financial decision-making.