As organizations increasingly turn to AI solutions for payroll systems, the importance of ensuring accuracy and efficiency has never been greater. These technologies not only help in anomaly detection but also streamline processes, allowing for more strategic focus. For those interested in visualizing solutions for various products, exploring resources like bag mockups can provide valuable insights.

The integration of artificial intelligence (AI) into payroll systems is revolutionizing the way organizations manage their employee payments. With the ever-growing complexities of payroll processing, ranging from tax calculations to compliance with local regulations, leveraging AI solutions for anomaly detection has become a necessity. The ability to effortlessly identify discrepancies in payroll data not only enhances operational efficiency but also safeguards companies against fraud and errors. This article delves into the sophisticated technologies powering AI payroll solutions, how they detect anomalies, and the benefits they bring to organizations.

The Evolution of Payroll Systems

Historically, payroll processing was a tedious manual task involving spreadsheets and lengthy calculations. As businesses expanded and employee numbers grew, traditional methods became impractical. The evolution of payroll systems has seen the introduction of software solutions that automate many processes. However, these systems still faced challenges in ensuring accuracy and compliance. With the advent of AI, payroll processing has entered a new era. Below are key milestones in the evolution of payroll systems:

- Manual record-keeping with paper forms and logs.

- The introduction of computerized payroll systems in the 1980s.

- Automated compliance updates to adapt to changing tax laws.

- Cloud-based solutions allowing for flexibility and remote access.

- The emergence of AI for predictive analysis and anomaly detection.

Understanding Anomalies in Payroll

Anomalies in payroll refer to discrepancies, errors, or unusual patterns that can lead to financial losses and compliance issues. These anomalies can arise from various sources:

Types of Anomalies

- Data Entry Errors: Mistakes made during manual input of salaries, hours worked, or deductions.

- Fraudulent Activities: Deliberate manipulation of payroll data by employees or administrators.

- System Integration Issues: Problems arising from mismatched data across different software systems.

- Compliance Violations: Non-adherence to state or federal regulations regarding payroll processing.

AI-Powered Anomaly Detection

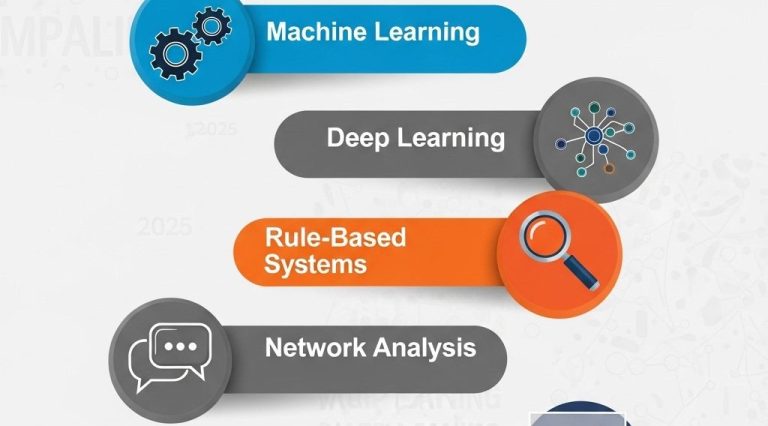

AI-powered payroll solutions utilize machine learning algorithms and data analytics to identify irregularities in payroll data. These technologies are capable of analyzing large volumes of data in real-time, making it possible to detect anomalies that would be challenging for human auditors to identify. Here’s how AI accomplishes this:

1. Machine Learning Algorithms

Machine learning algorithms are trained using historical payroll data to establish patterns and detect deviations. For example:

| Algorithm Type | Application |

|---|---|

| Supervised Learning | Identifies patterns based on labeled data (e.g., correctly processed payrolls). |

| Unsupervised Learning | Detects anomalies in unlabeled data (e.g., unexpected salary spikes). |

2. Natural Language Processing (NLP)

NLP helps in analyzing text-based data, such as employee comments or feedback, to uncover potential issues. For example, if multiple employees report discrepancies in their paychecks, NLP can aggregate and analyze these reports for patterns.

3. Predictive Analytics

Predictive analytics uses historical data to forecast future conditions. By understanding trends, payroll systems can identify potential anomalies before they occur, allowing for proactive measures.

Benefits of AI in Payroll Processing

The advantages of implementing AI for payroll anomaly detection are significant and multifaceted:

Efficiency and Speed

AI can process payroll data much faster than manual methods. This efficiency allows organizations to handle payroll in a timely manner, ensuring employees are paid accurately and on time.

Cost Reduction

By automating anomaly detection, organizations can reduce the costs associated with overpayments, underpayments, and the administrative burden of manual audits.

Enhanced Accuracy

AI-driven systems minimize human errors that can occur during data entry or processing, leading to more accurate payroll outcomes.

Improved Compliance

AI systems can be programmed to stay updated with the latest regulations and ensure compliance, reducing the risk of legal issues.

Challenges and Considerations

While AI-powered payroll solutions offer numerous benefits, there are also challenges that organizations should be aware of:

1. Data Privacy Concerns

With the increasing reliance on data analytics, organizations must ensure that sensitive employee information is protected against breaches. Compliance with data protection regulations such as GDPR is crucial.

2. Implementation Costs

Initial investments in AI technology can be substantial, and businesses must evaluate the return on investment.

3. Resistance to Change

Employees may resist adopting new technologies. Ensuring proper training and buy-in from staff is essential for successful implementation.

Future Trends in AI Payroll Solutions

The future of payroll systems is poised for further transformation as technology advances:

1. Continued Advancement of AI

As AI technology evolves, payroll systems will become even more sophisticated, offering advanced anomaly detection capabilities.

2. Integration with Other HR Functions

Future payroll solutions will likely integrate seamlessly with other HR functions, creating a more holistic approach to employee management.

3. Greater Use of Blockchain Technology

Blockchain could enhance payroll security and transparency by providing immutable records of payroll transactions.

Conclusion

AI payroll solutions represent a significant leap forward in the management of employee compensation. By effectively detecting anomalies, these systems not only streamline operations but also fortify organizations against potential financial pitfalls. As technology continues to evolve, businesses that embrace AI in payroll will likely lead the charge in operational excellence and employee satisfaction.

FAQ

What are AI payroll solutions?

AI payroll solutions are automated systems that use artificial intelligence to manage payroll processes, ensuring accuracy and efficiency in calculations, compliance, and reporting.

How do AI payroll solutions detect anomalies?

AI payroll solutions utilize machine learning algorithms to analyze payroll data and identify irregular patterns or discrepancies, flagging them for review to prevent errors and fraud.

What are the benefits of using AI for payroll processing?

Benefits of AI in payroll processing include increased accuracy, reduced manual errors, enhanced compliance, time savings, and the ability to quickly adapt to changing regulations.

Can AI payroll solutions integrate with existing HR systems?

Yes, most AI payroll solutions are designed to integrate seamlessly with existing HR systems, allowing for streamlined data management and improved overall efficiency.

Is employee data secure with AI payroll solutions?

Yes, reputable AI payroll solutions implement robust security measures, including encryption and access controls, to protect sensitive employee data from unauthorized access.

How can businesses choose the right AI payroll solution?

Businesses should consider factors such as scalability, user-friendliness, integration capabilities, customer support, and specific features that align with their payroll needs when selecting an AI payroll solution.