Maximizing tax deductions is essential for preserving your wealth in today’s financial environment. By understanding various strategies, you can ensure you are taking full advantage of all available deductions. For instance, keeping organized records can make a significant difference. Additionally, investing in high-quality bag visuals for your business can lead to improved marketing and, ultimately, greater savings.

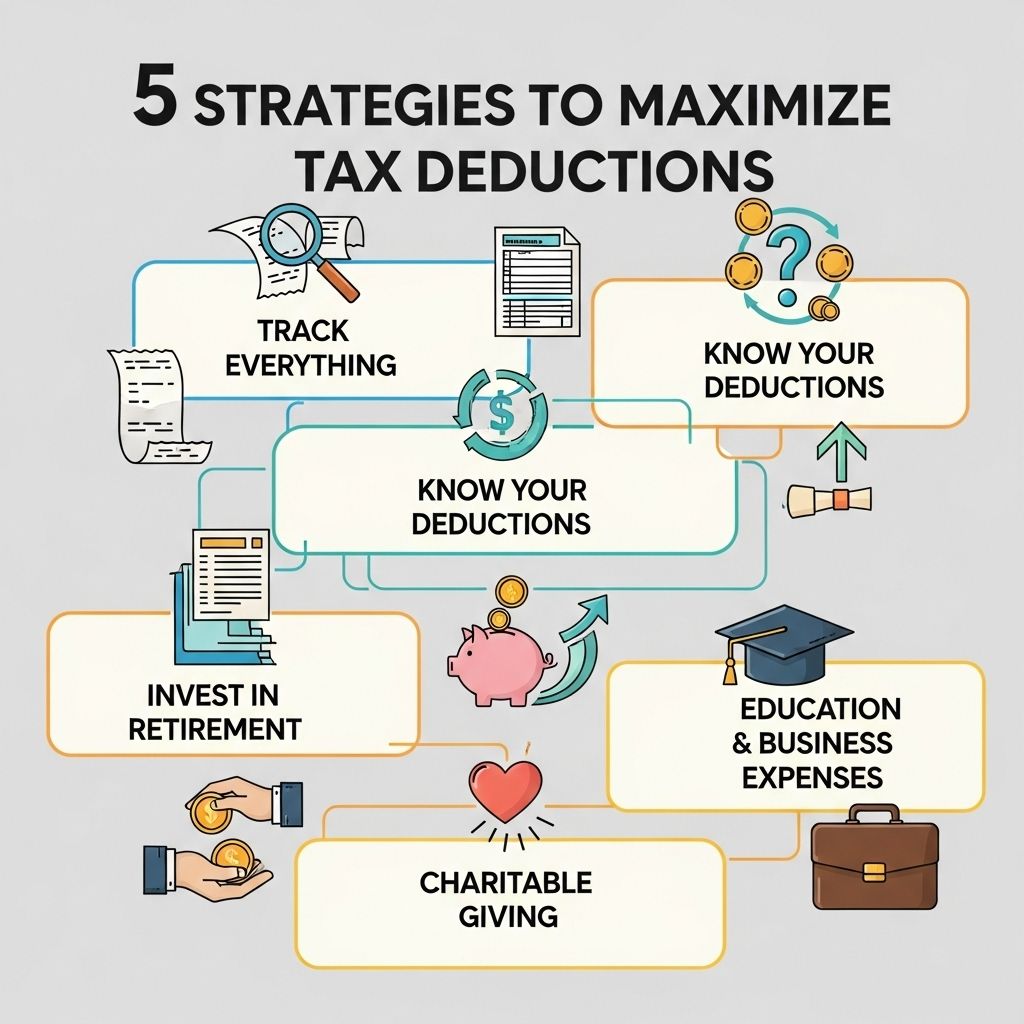

In today’s complex financial landscape, navigating tax deductions can significantly impact your overall tax liability. Understanding which deductions are available and how to maximize them can lead to substantial savings. This article explores various strategies that can help you make the most of your tax deductions, ensuring that you keep more of your hard-earned money in your pocket. Whether you are a business owner, an employee, or a freelancer, these strategies can be tailored to fit your unique financial situation.

Understand the Types of Tax Deductions

Before diving into strategies, it’s essential to familiarize yourself with the different types of tax deductions available:

- Standard Deduction: A fixed dollar amount that reduces your taxable income, which varies based on your filing status.

- Itemized Deductions: Specific expenses that taxpayers can claim on their tax return instead of the standard deduction, such as medical expenses, mortgage interest, and state taxes.

- Above-the-Line Deductions: Adjustments to your gross income that can be taken regardless of whether you itemize, such as student loan interest and retirement plan contributions.

Strategy 1: Leverage Itemized Deductions

For many taxpayers, itemizing deductions can lead to greater tax savings than taking the standard deduction. Here are some items commonly included in itemized deductions:

Common Itemized Deductions Include:

- Medical expenses (above 7.5% of your adjusted gross income)

- Mortgage interest

- Property taxes

- Charitable contributions

- Unreimbursed business expenses (for employees)

To effectively leverage itemized deductions, maintain thorough records of all qualifying expenses throughout the year. Consider using accounting software or hiring a tax professional to help you identify which expenses qualify.

Strategy 2: Maximize Retirement Contributions

Contributing to retirement accounts such as a 401(k) or an IRA not only prepares you for the future but also provides current tax benefits. Here’s how to take advantage of these deductions:

Contribution Limits for 2023:

| Account Type | Contribution Limit |

|---|---|

| 401(k) | $22,500 (plus $7,500 catch-up for those aged 50+) |

| Traditional IRA | $6,500 (plus $1,000 catch-up for those aged 50+) |

By maxing out your contributions, you can significantly reduce your taxable income while investing for retirement. Keep in mind that contributions to a Roth IRA do not provide immediate tax deductions but offer tax-free withdrawals in retirement.

Strategy 3: Take Advantage of Education Tax Deductions and Credits

Education-related expenses can often be hefty but come with potential tax benefits. There are various deductions and credits available:

Key Education Deductions and Credits:

- American Opportunity Tax Credit: A credit of up to $2,500 for qualified education expenses for the first four years of higher education.

- Lifetime Learning Credit: A credit of up to $2,000 per tax return for qualified tuition and related expenses.

- Tuition and Fees Deduction: A deduction of up to $4,000 for qualified tuition and fees.

To qualify for these credits, ensure that you meet the income thresholds and keep documentation of your educational expenses. This not only reduces your tax bill but also encourages further education and skill development.

Strategy 4: Utilize Business Expenses for Tax Deductions

For self-employed individuals, freelancers, or business owners, understanding which expenses can be deducted is crucial. Common business expenses include:

Deductible Business Expenses:

- Home office expenses

- Business travel costs

- Equipment and software purchases

- Meals and entertainment (subject to limits)

- Marketing and advertising expenses

To maximize deductions, maintain detailed records of all expenses and separate personal expenses from business-related ones. Using accounting software designed for small businesses can streamline this process.

Strategy 5: Keep Accurate Records and Documentation

The foundation of maximizing tax deductions lies in maintaining accurate records. Here are best practices for effective documentation:

Best Practices for Record-Keeping:

- Organize Receipts: Use folders or digital tools to categorize receipts by expense type.

- Track Mileage: If you use your vehicle for business purposes, keep a detailed log of your mileage.

- Utilize Technology: Consider apps or software that can help you track expenses in real-time.

- Review Annually: Regularly review your records to ensure nothing is overlooked before tax season.

Proper documentation not only simplifies the tax preparation process but also protects you in case of an audit.

Conclusion

Maximizing tax deductions requires a proactive approach and a solid understanding of the various strategies available. By leveraging itemized deductions, maximizing retirement contributions, utilizing education-related deductions, claiming business expenses, and keeping thorough records, taxpayers can significantly reduce their taxable income. The key is to stay informed, organized, and prepared throughout the year to take full advantage of the deductions available to you. Consulting with a tax professional can further enhance your tax strategy, ensuring that you capitalize on all potential savings while remaining compliant with tax laws.

FAQ

What are the best strategies to maximize tax deductions?

Some effective strategies include keeping detailed records of expenses, utilizing tax-advantaged accounts, taking advantage of charitable contributions, maximizing retirement contributions, and staying informed about changing tax laws.

How can I keep track of my expenses for tax deductions?

You can track your expenses by using accounting software, maintaining organized receipts, and categorizing your spending throughout the year to ensure you don’t miss any deductions.

Are there specific tax-advantaged accounts I should consider?

Yes, consider contributing to accounts such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and retirement accounts like IRAs or 401(k)s to maximize your tax deductions.

Can charitable donations increase my tax deductions?

Absolutely. Donating to qualified charitable organizations can provide significant tax deductions, so be sure to keep records of your donations and the organizations.

What deductions can I claim for home office expenses?

If you work from home, you may be eligible to deduct expenses such as a portion of your rent or mortgage, utilities, and internet costs, provided you meet the IRS requirements for a home office.

How often should I review my tax deductions?

It’s wise to review your tax deductions regularly—ideally quarterly—to ensure you are on track to maximize your deductions and to adjust your financial strategies as needed.