As the gig economy continues to flourish, navigating the tax landscape is crucial for online earners. Understanding your obligations and staying organized with finances can pave the way for success. For those looking to effectively showcase their work in the online realm, a creative book presentation can enhance your portfolio and provide greater visibility.

As more individuals transition to online work and digital entrepreneurship, understanding the intricacies of tax obligations has become increasingly vital. The landscape of online earning is not only lucrative but also complex, with various rules and regulations that can impact your bottom line. Whether you’re a freelancer, an e-commerce store owner, or a creator monetizing your content, being tax-savvy is imperative to maximize your earnings and minimize your liabilities.

Understanding Your Tax Obligations

The first step in navigating taxes as an online earner is to understand what obligations you have. This involves knowing the tax structures and laws that apply to your specific situation. Here are some key points:

- **Types of Income**: Income earned through freelancing, affiliate marketing, e-commerce, or content creation counts as taxable income.

- **Tax Classification**: Decide whether you will operate as a sole proprietor, LLC, or corporation, as this affects your taxes.

- **State Regulations**: Different states have different tax rates and regulations, so be aware of where you reside and operate.

- **Self-Employment Tax**: Remember, freelancers and independent contractors must pay self-employment taxes on top of income taxes.

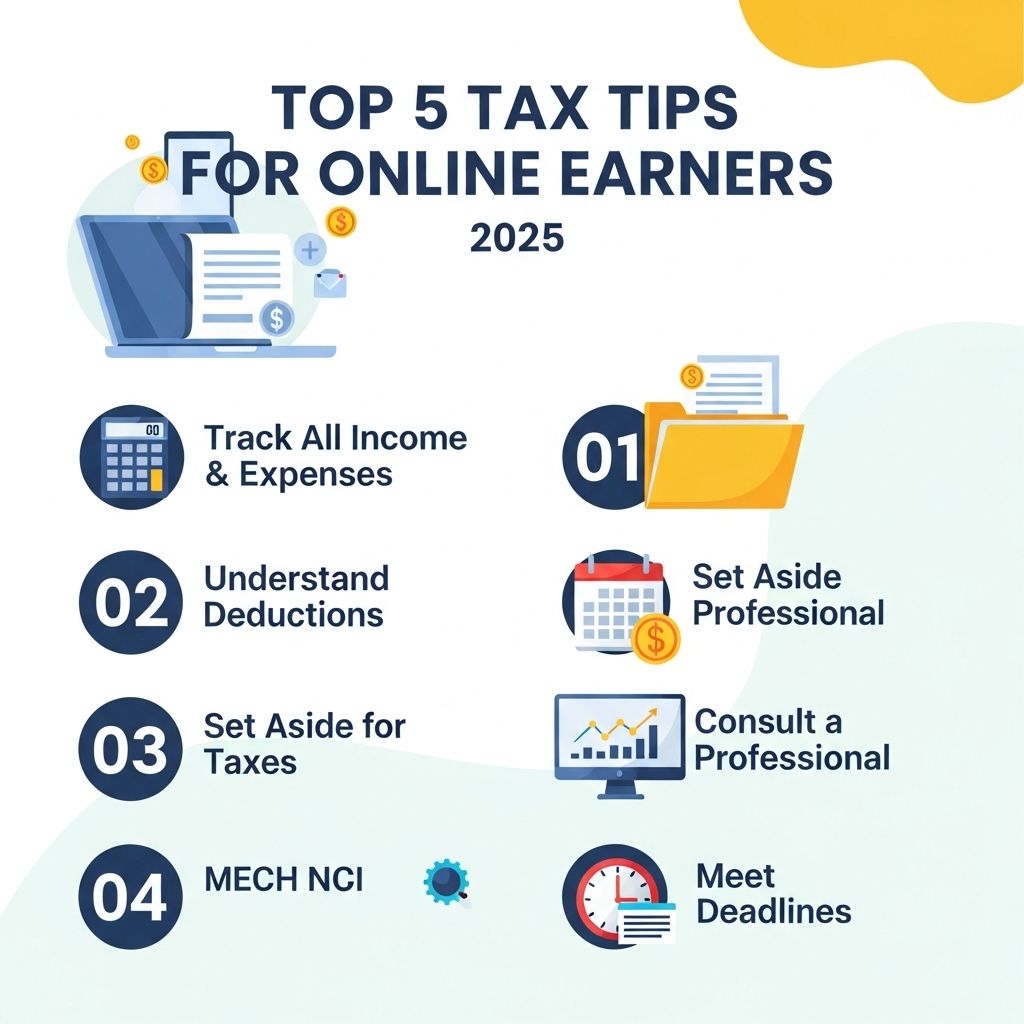

1. Keep Detailed Records

One of the most crucial pieces of advice for online earners is to maintain meticulous records of all income and expenses. Keeping track of your financial activities will not only simplify tax filing but also help you in the event of an audit. Here are some aspects to consider:

What to Record

- Income: All income should be documented, including payments from clients, sales from e-commerce, and ad revenues.

- Expenses: Track all business expenses, including software subscriptions, advertising costs, and office supplies.

- Receipts: Keep all receipts and invoices as proof of income and expenses.

Tools for Record Keeping

Utilizing accounting software can streamline the record-keeping process. Some popular options include:

- QuickBooks

- Xero

- FreshBooks

2. Understand Deductions and Credits

Maximizing deductions and credits can significantly reduce your taxable income. Here are some valuable deductions that online earners often overlook:

Common Deductions

| Deductions | Description |

|---|---|

| Home Office Deduction | If you work from home, you may deduct a portion of your rent or mortgage. |

| Internet and Phone Bills | Expenses directly related to your business use of internet and phone services. |

| Software and Subscriptions | Costs of any software, tools, or subscriptions that aid your business. |

3. Set Aside Money for Taxes

As an online earner, it’s crucial to set aside a portion of your income for taxes. Unlike traditional employees, taxes are not withheld from your payments. Here’s how you can effectively manage your finances:

Best Practices for Tax Management

- **Estimate Quarterly Payments**: If you’re self-employed, you may need to pay estimated taxes quarterly. Use IRS Form 1040-ES for calculations.

- **Save Consistently**: Set aside at least 25-30% of your income to cover your tax bill.

- **Use a Separate Account**: Consider opening a dedicated tax savings account to keep these funds separate from your operational funds.

4. Leverage Technology for Tax Filing

With the advent of technology, tax filing has become much easier and more efficient. Here are some tools that can assist you in the process:

Popular Tax Filing Software

- TurboTax

- H&R Block

- TaxAct

These platforms not only help in filing but also provide features like:

- Guided walkthroughs for tax preparation

- Integration with accounting software

- Maximizing deductions

5. Stay Informed About Law Changes

Tax laws can change annually, which means staying updated is crucial for online earners. Here are some tips to help you keep abreast of changes:

Ways to Stay Informed

- **Follow IRS Updates**: Regularly check the IRS website for any revisions in tax laws.

- **Subscribe to Tax Newsletters**: Sign up for newsletters that focus on tax updates relevant to freelancers and online businesses.

- **Consult a Tax Professional**: An expert can provide insights tailored to your specific situation and help you navigate complex tax scenarios.

Conclusion

Being an online earner comes with its own set of challenges and rewards, especially when it comes to managing taxes. By understanding your obligations, keeping detailed records, maximizing deductions, saving adequately, leveraging technology, and staying informed about tax law changes, you can pave the way for a more financially sound future. Embrace these tips to ensure that your online earning journey remains profitable while adhering to the necessary tax requirements.

FAQ

What are the top tax deductions for online earners in 2025?

In 2025, online earners can benefit from deductions like home office expenses, internet and phone bills, software subscriptions, and business-related travel costs. Keeping accurate records is crucial to maximize these deductions.

How can online freelancers track their income for tax purposes?

Online freelancers should maintain detailed records of all income through invoicing software or spreadsheets. Regularly updating these records can simplify the tax filing process and ensure compliance.

What are estimated tax payments and do online earners need to make them?

Estimated tax payments are quarterly payments made to the IRS by self-employed individuals to cover their tax liability. Online earners often need to make these payments if they expect to owe more than $1,000 in taxes.

Are online business expenses tax-deductible?

Yes, many expenses incurred while running an online business can be tax-deductible, including marketing costs, website hosting, and professional services. It’s important to keep receipts and documentation for these expenses.

How can online earners prepare for tax season effectively?

Online earners should organize their financial documents throughout the year, keep track of income and expenses, consult a tax professional if needed, and familiarize themselves with tax software to streamline the filing process.

What should online earners know about state taxes in 2025?

In 2025, online earners should be aware that state tax obligations may vary depending on their location and the nature of their business. It’s essential to research state tax laws and comply with any local requirements.