In today’s business environment, precision in payroll processing is paramount for success. Errors not only affect employee trust but can lead to significant financial repercussions. Leveraging technology, such as AI, can help streamline payroll operations and minimize mistakes, much like how mockup templates for bags serve to enhance the creative process in design.

In today’s fast-paced business environment, maintaining accurate payroll is critical for employee satisfaction and organizational efficiency. However, manual payroll processes are prone to human errors that can result in costly financial discrepancies and even legal complications. With the advent of artificial intelligence (AI), businesses can now leverage advanced technologies to uncover and rectify payroll errors more efficiently than ever before.

The Importance of Accurate Payroll

Accurate payroll processing is essential for numerous reasons, including:

- Employee Trust: Employees expect to be paid correctly and on time. Inaccuracies can lead to dissatisfaction and decreased morale.

- Legal Compliance: Payroll errors can result in penalties and fines from regulatory bodies, which can severely impact a company’s financial standing.

- Financial Health: Mistakes in payroll can affect cash flow and financial planning, disrupting overall business operations.

How AI Can Transform Payroll Processing

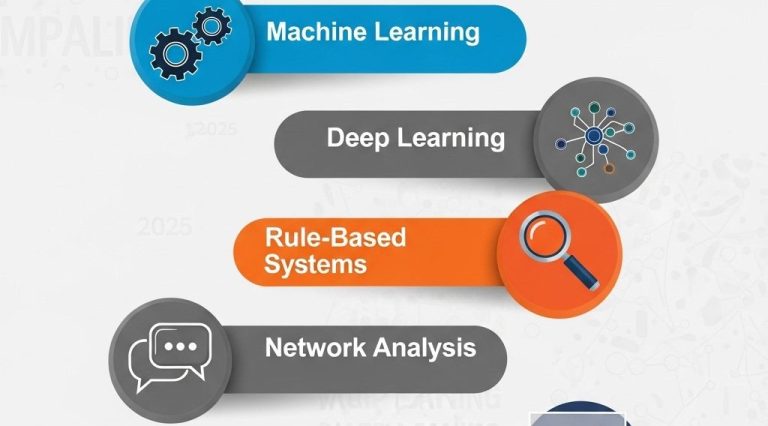

AI technologies offer a range of tools that can enhance payroll accuracy, streamline processes, and reduce manual workload. Below are several key areas where AI can make a significant impact:

1. Automated Data Entry

Manual data entry is a leading cause of payroll errors. AI-powered systems can automate data entry through:

- Optical Character Recognition (OCR) to extract data from physical documents.

- APIs that pull data from various HR systems in real-time.

- Machine learning algorithms that recognize patterns and correct inputs.

2. Predictive Analytics

AI can analyze historical payroll data to predict potential errors before they occur. By utilizing predictive analytics, organizations can:

- Identify patterns in past payroll discrepancies.

- Flag anomalies based on statistical deviations.

- Enhance decision-making processes through data-driven insights.

3. Real-time Error Detection

AI systems can monitor payroll processing in real-time, instantly identifying errors such as:

| Error Type | Description | Potential Impact |

|---|---|---|

| Incorrect Hours | Over or under-reported employee hours. | Financial loss or employee dissatisfaction. |

| Tax Miscalculations | Errors in withholding or payroll tax calculations. | Legal issues and penalties. |

| Benefit Deductions | Inaccurate withholding for health plans or retirement benefits. | Employee mistrust and compliance risks. |

4. Enhanced Compliance Monitoring

AI can ensure that payroll practices adhere to local and federal regulations by continuously updating compliance requirements and:

- Automating calculations for changes in tax laws.

- Validating employee classifications to avoid misclassification penalties.

- Generating reports that comply with governmental regulations.

Challenges of Implementing AI in Payroll

While AI has the potential to revolutionize payroll processing, businesses should be aware of the challenges that may arise during implementation:

Data Privacy Concerns

Payroll data is sensitive, and organizations must ensure that AI systems comply with data protection regulations, such as GDPR or CCPA. This includes:

- Implementing strong encryption protocols.

- Training employees on data privacy best practices.

- Regularly auditing AI systems for compliance.

Integration with Existing Systems

Integrating AI solutions with legacy payroll systems can be complex. Businesses should:

- Assess current systems’ compatibility with AI technologies.

- Invest in scalable solutions that can grow with the business.

- Work with IT specialists to facilitate smooth transitions.

Talent Gap

There is a growing demand for data analysts and AI specialists who can manage and interpret AI-generated data. Companies need to:

- Provide training for existing staff.

- Hire skilled professionals in AI and data analytics.

- Foster a culture of continuous learning to keep pace with technological advancements.

Best Practices for Successful AI Implementation in Payroll

To harness the full potential of AI in payroll processing, organizations should consider the following best practices:

1. Conduct a Needs Assessment

Identify the specific payroll issues that AI technologies can address, such as error rates, processing times, or compliance concerns. This will help in selecting the right tools and technologies.

2. Choose the Right AI Solution

Research and evaluate various AI vendors to find solutions that align with your organization’s needs. Consider factors such as:

- Cost

- Scalability

- User-friendliness

- Customer support

3. Train Employees

Provide comprehensive training for employees to ensure they understand how to use AI tools effectively. Continuous education will also help in adapting to new technologies.

4. Monitor and Optimize

Regularly review the effectiveness of AI systems and make necessary adjustments. This includes:

- Analyzing user feedback.

- Conducting performance evaluations.

- Staying updated on industry trends and advancements.

Conclusion

AI-powered detection of payroll errors represents a transformative shift in how organizations approach payroll processing. By embracing these technologies, businesses can achieve greater accuracy, efficiency, and compliance, ultimately fostering a more positive work environment for employees. As AI continues to evolve, so too will the landscape of payroll processing, making it imperative for organizations to stay informed and agile in their approach.

FAQ

What is AI-powered payroll error detection?

AI-powered payroll error detection uses advanced algorithms and machine learning to identify discrepancies and errors in payroll processing, ensuring accurate employee compensation.

How can AI improve payroll accuracy?

AI can analyze large datasets quickly, flagging potential errors and inconsistencies that might be missed by manual processes, thus enhancing overall payroll accuracy.

What types of payroll errors can AI detect?

AI can detect various payroll errors, including incorrect employee hours, miscalculated overtime, tax withholding mistakes, and duplicate payments.

Is AI-powered payroll detection suitable for all businesses?

Yes, AI-powered payroll detection can benefit businesses of all sizes by improving accuracy, saving time, and reducing the risk of costly payroll errors.

How does AI integration affect payroll processing time?

Integrating AI into payroll processing can significantly reduce the time required to audit and verify payroll data, allowing for faster and more efficient payroll cycles.

What are the benefits of using AI for payroll error detection?

The benefits include increased accuracy, reduced manual workload, quicker error resolution, and improved compliance with labor laws and regulations.